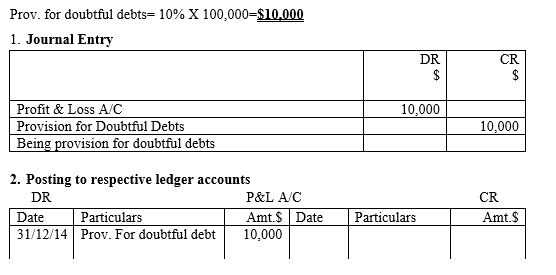

Double Entry for Provision for Doubtful Debts

The solution for this question is as follows. For example here is a debtors ledger with a number of individual.

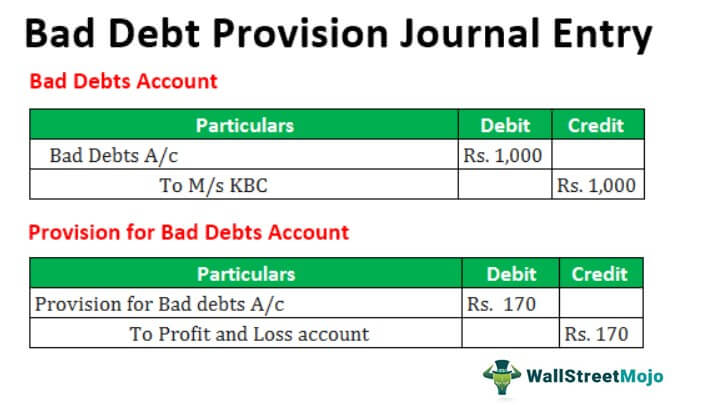

Bad Debt Provision Meaning Examples Step By Step Journal Entries

6000 have been omitted be recorded in the books.

. Also notice that in the first entry the estimated uncollectible accounts and allowance for doubtful accounts are the. Entry 4 economic object 7099 has been added as an alternative for the recording of accumulated amortization. Alternatively while recoding the entry for depreciation incremental depreciation due to the revaluation ie.

Enter the email address you signed up with and well email you a reset link. Due to this principle the two sides of Balance Sheet are always equal and the following accounting equation will always hold good at any point of time. The Trial Balances.

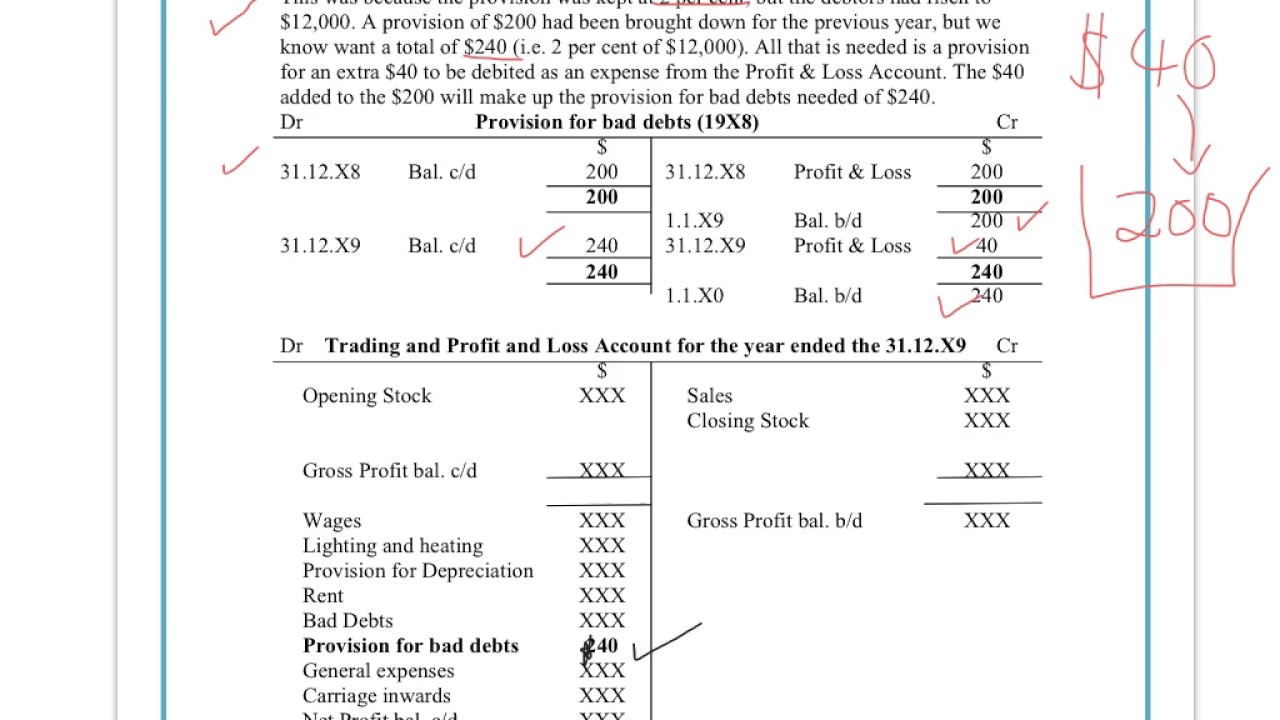

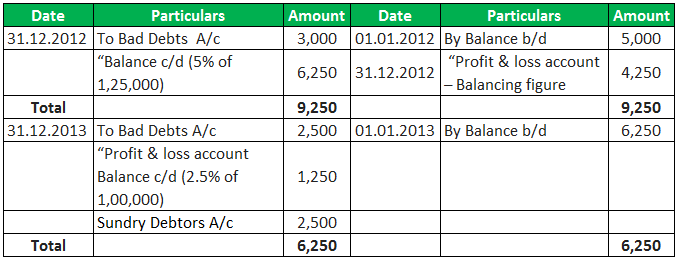

Example From the following transactions identify the accounts involved and classify them according to modern and traditional approaches of classification of accounts. As previously mentioned we not only have the general ledger but also two other subsidiary or supporting ledgers. C Provision for doubtful debts was to be made equal to.

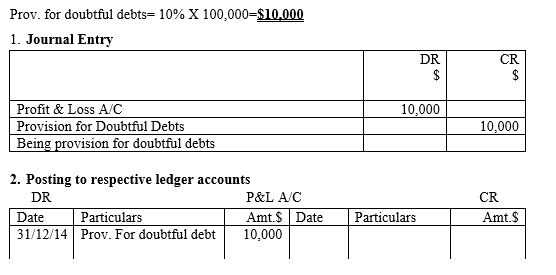

Now lets assume that at the start of year 4 company identifies that value of asset has decreased to. Inventory valuation and its impact on financial statements is also covered. Madhu and Vidhi decided to admit Gayatri as a new partner from 1st April 2016 and their new profit-sharing ratio will be 2.

General reserve provision for doubtful debts. Outline the double entry system of book-keeping. - The Debtors Ledger - The Creditors Ledger.

Gayatri brought 400000 as her capital and her share of goodwill premium in cash. The other examples of provisions are. Allowance for doubtful accounts Wrong.

If this occurs during the accounting year then the company can DIRECTLY write it off in the Income Statement otherwise a. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. Ram started business with cash Rs.

Assets Liabilities Capital. Bad debts and provision for doubtful debts. A provision can be created due to a number of factors.

Accruals and prepayments. 8333 can be charged to the revaluation surplus account. Other items Sales return reserve for discount on accounts payable.

Treatments to record adjustments for accruals and prepayments bad debts provision of doubtful debts and bad debts recovered are included. Your allowance for doubtful accounts estimation for the two aging periods would be 550 300 250Allowance for doubtful accounts journal entryWhen it comes to bad debt and ADA there are a few scenarios you. 21 The System of Double Entry of Book-Keeping.

Entry 1 the economic object used when capitalizing the asset has changed to 7099. In balance sheet the balance in allowance for doubtful accounts is deducted from the total receivables to report them at their net realizable value or carrying value. He has worked as an accountant and consultant for more than 25.

Double entry bookkeeping part A 3. The system of recording transaction based on this principle is called as Double. According to a double-entry system every transaction is recorded in a journal debiting one account and crediting the other for the same amount of money with an explanation.

Long term debts Rs3200000 Rs250000 Rs20000 Rs100000 Rs. The mootness of the case in relation to the WMCP FTAA led the undersigned ponente to state in his dissent to the Decision that there was no more justiciable controversy and the plea to nullify the Mining Law has become a virtual petition for declaratory relief26 The entry of the Chamber of Mines of the Philippines Inc however has put into. It is calculated to cover the cost of debts that are expected to remain unpaid during an accounting period.

V Creditors were unrecorded to the extent of 1000. Carrying value of asset at the end of year 3 would be as follows. A contract is a legally enforceable agreement that creates defines and governs mutual rights and obligations among its parties.

Enter the email address you signed up with and well email you a reset link. Pass the necessary journal entries prepare the revaluation account and partners capital accounts and show the Balance Sheet after the admission of C. Iv A provision for bad and doubtful debts is to be created at 5 of debtors.

Allowance for doubtful accounts Right. Double entry bookkeeping part B 5. Provision For Doubtful debts takes into consideration that when a company conducts it business there is bound to be some billings during the year whereby the customers might not be able to pay hence eventually turning bad.

Calculate total Assets to debt ratio from the following. 5 provision be made for doubtful debts on Debtors and a provision of 2 be made on Debtors and Creditors for discount. Below is the Calculation of Long term Debts-Long term debts total Debts- Creditors Bills payables- Short term Borrowings Outstanding Exp.

5000 are outstanding for salaries. Provision for discount on accounts receivable etc. Petty cash book.

Guarantee product warranties Requirements for creating provision. Bad debt expense Wrong. A contract typically involves the transfer of goods services money or a promise to transfer any of those at a future dateIn the event of a breach of contract the injured party may seek judicial remedies such as damages or rescission.

Depreciation and disposal of fixed assets. Entry 2 and 5a the economic object for the reduction in the lease obligation has changed from 6299 to 1221. A Goodwill of the firm was valued at 300000.

Revision - Capital Leases - Scenario B. Business documents and books of prime entry. 30000 Long term debts Rs.

C Double entry system Books of prime entry Subsidiary Books Cash Book d Journal Ledger Trial Balance e Depreciation Methods Straight Line and Diminishing Balance methods only f Rectification of Errors g Opening entries Transfer entries Adjustment entries Closing entries h Bank Reconciliation Statements 2. 7A provision for potential bad debts in accounts receivable is debited to which account. 1000 are prepaid for insurance.

1480 for accrued income are be shown in the books. We also learned that all individual debtor T-accounts go in the debtors ledger and all individual creditor T-accounts go in the creditors ledger. B Land and Building was found undervalued by 26000.

Understand How To Enter The Provision For Bad Debts Transactions Using The Double Entry System Youtube

Bad Debt Provision Meaning Examples Step By Step Journal Entries

Accounting Nest Intermediate Bad Debts And Provision For Doubtful Debts

No comments for "Double Entry for Provision for Doubtful Debts"

Post a Comment